Refine your search

Chris Potter

Let’s face it—retail isn’t what it used to be. The game has changed, and so has the role of the sales rep. If you’re still relying on charm, gut instinct, and yesterday’s tactics, you risk becoming irrelevant. Or worse—a sales dinosaur.

Today’s top-performing sales professionals aren’t just sellers. They’re category experts, data analysts, and tech-savvy partners to their customers. They understand that building value in-store isn’t about pushing stock—it’s about using insight, collaboration, and smart tools to grow the business together.

So if you’re out on the road calling into Tesco, Asda, Co-op, or independents, it’s time to ask yourself: are you evolving… or fossilising?

1. Ditch The Gut Feel - Let Data Lead The Way

Old-School Rep:

Relies on memory, past experience, or what “usually works” in store. Decisions are often made on the fly, with little reference to hard numbers.

Modern Rep:

Before they step into store, they’ve reviewed EPOS data from the retailer, analysed sales trends, and know exactly which SKUs need attention. They’re using tools like IRI or Nielsen, and field apps that surface data instantly. It’s about making every visit count—because they’re not just working hard, they’re working smart.

Example:

Instead of saying, “This line’s done well lately,” a modern rep might say: “This SKU’s down 12% on last month in this store, but it's up nationally. Let’s check if it’s in the right location or if stock’s not come through.”

2. From Pushing Products to Managing Categories

Old-School Rep:

Focused solely on getting stock in and out. The goal? Shift cases, hit call numbers, and tick the visit box.

Modern Rep:

Understands category management. They work with store managers to optimise shelf space, ensure the right mix of products is available, and support strategic promotions. They think like partners—not pushers.

Example:

If a rep notices that healthier snacks are flying in urban stores, they might recommend adapting the range to reflect that trend locally—helping the store grow the whole category, not just shift one brand.

3. Using AI & Tech to Stay Ahead on the Road

Old-School Rep:

Takes notes on paper, manually reports back to the office, and uses emails for everything. Time-consuming. Error-prone.

Modern Rep:

Uses AI-powered mobile apps that flag which stores need attention based on sales dips or stock issues. Speech-to-text updates CRM instantly. Some tools even recommend tailored talking points for each visit based on past orders and performance.

Example:

Your app tells you: “Asda, Store #213 is 20% below forecast on chilled drinks. Promotion started Monday. Check placement.” That’s AI helping you be proactive—not reactive.

4. The Modern Toolkit: Are you Equipped?

| Old-School Rep | Modern Rep |

| Paper notes & call cards | Mobile CRM & store insights in hand |

| Pushes the same products | Tailors range using store-specific data |

| Focuses on product features | Focuses on solving store/category problems |

| Tracks results manually | Uses live dashboards & real-time alerts |

| Reactive to issues | Proactive, thanks to AI & predictive tools |

Final Thoughts: Evolve or Expire

Being on the road doesn’t mean being out of touch. In fact, the reps who thrive today are the ones who embrace the tools available to them. They’re faster, sharper, and more valuable to their customers than ever before.

Retail is moving. Stores expect more. And sales reps who still rely on old habits risk being left behind.

So here’s the choice:

Evolve into a data-driven, insight-led, tech-powered rep—or become a dinosaur.

Your future in sales depends on it.

For further information or advice please Contact Us

Haws Watering Cans

Cavendish Maine impressed us throughout the recruitment process. They took the time to visit and understand our business and the role. They guided us throughout the process, presenting us with a high calibre of candidates and the outcome far exceeded our expectations.

Alide Hire Services

I have had the pleasure of working with Cavendish Maine as both a candidate and a client and I would recommend the Cavendish Maine team without hesitation. Their approach differs in as much as they truly seek to understand the brief and ensure the candidate and client’s needs are aligned.

EP Barrus

We have used Cavendish Maine many times for finding suitable candidates and I have to say that they do an incredible job in finding the right people.

Mr Fothergill’s Seeds Ltd

Cavendish Maine have a clear grasp of the client’s and candidates’ needs evidenced by a tight list of potential recruits and an erudite appraisal of their suitability. I found their perspective refreshingly accurate and they understood and listened to my concerns.

You walked into your salary review confident, prepared, and armed with evidence of your contributions. But instead of the well-earned pay rise you were expecting, you got a disappointing "not this time." It’s frustrating, demotivating, and—if you’re honest—probably a bit of a confidence hit.

But let’s take a step back. In a market where top talent is in high demand, not getting a pay rise isn’t necessarily a reflection of your worth. It’s a signal—one that tells you it’s time to reassess, strategise, and take control of your career path. Here’s how you turn a rejection into an opportunity.

1. Reality Check: Have You Truly Earned it?

It’s easy to assume that tenure equals entitlement to a salary bump, but in reality, pay rises are about impact, not just time served. Before pushing back, ask yourself the hard questions:

- Have you consistently exceeded targets and expectations?

- Can you point to specific contributions that have improved revenue, efficiency, or client satisfaction?

- Have you taken on additional responsibilities that justify an increase?

If the answer is a clear "yes," then you have every reason to challenge the decision. If you’re not sure, this is a chance to refocus, refine your goals, and set yourself up for a stronger case in the next review.

2. Build a Bulletproof Case

Most employers won’t hand out pay rises simply because you ask. You need undeniable proof of your value.

- Industry benchmarks – Research salaries for your role within the insurance sector. If you’re being underpaid, have the numbers to back it up.

- Quantifiable achievements – Have you grown a book of business, streamlined processes, or enhanced client retention? Make it measurable.

- Revenue impact – If your work directly contributes to financial growth, spell it out. Numbers are hard to argue with.

Once you’ve built your case, request a follow-up meeting with your manager. Present your evidence clearly and position yourself as an asset the business can’t afford to undervalue.

3. Look Beyond Salary – What Else Can You Negotiate?

Sometimes, a company genuinely doesn’t have the budget for pay rises. But that doesn’t mean you can’t improve your overall package.

Consider negotiating:

- Accomplishments: Flexible working (remote days, compressed hours)

- Additional leave (extra holiday allowance)

- Professional development (funding for qualifications, training, or industry events)

- Performance bonuses (a results-based financial incentive)

These perks can sometimes have more value than a salary increase, so think strategically about what benefits would enhance your role and work-life balance.

4. Stay Professional, But Stay Hungry

A "no" today doesn’t mean "no" forever. Your response to rejection defines your career progression. Instead of letting it demotivate you, turn it into fuel.

- Ask for constructive feedback – Understand what you need to improve to secure a future increase

- Agree on measurable targets – Set clear goals with your manager so there’s no ambiguity in your next review

- Continue delivering value – The best way to earn leverage is to make yourself indispensable.

5. Know When It’s Time to Move On

If you’re consistently overlooked, underpaid, and see no path for progression, it might be time to evaluate your options.

The insurance industry is currently experiencing a talent shortage, and skilled professionals—particularly those in broking, underwriting, and claims—are in high demand. If your current employer isn’t recognising your worth, others will.

Where Do You Go From Here?

If you’re feeling stuck and want a clearer picture of your market value and career opportunities, let’s talk. As specialists in insurance recruitment, we have access to exclusive roles, salary insights, and market trends that can help you take control of your career.

Get in touch today to explore your options.

Your performance review and salary review may feel like they go hand in hand, but they are often separate conversations. While a performance review evaluates your contributions and growth, a salary review determines your compensation based on business and market conditions. Understanding the distinction between the two and preparing strategically can significantly impact your career progression and earning potential.

What is a Performance Review?

A performance review is an opportunity for you and your manager to discuss your achievements, areas for improvement, and professional goals. It provides a structured setting to evaluate how well you are meeting your objectives and where you can develop further.

In the Insurance sector, performance reviews may focus on:

- Meeting sales or retention targets in broker/client facing roles.

- Successfully managing claims or risk assessments.

- Building strong client relationships and increasing customer satisfaction.

- Demonstrating compliance with industry regulations and internal processes.

Use your performance review to highlight your key contributions, such as exceeding renewal targets, securing high-value policies, or improving operational efficiencies.

What is a Salary Review?

A salary review assesses whether your current pay reflects your experience, responsibilities, and contributions. This is influenced by factors like industry salary benchmarks, company performance, and your ability to demonstrate exceptional value.

Your employer may consider:

- Your revenue generation (for brokers, underwriters, and sales professionals).

- Your ability to mitigate risk and reduce claims costs (for claims and risk professionals).

- Industry demand for your expertise, especially in specialist insurance areas.

- Any new qualifications, experience or training you've completed (e.g., CII certifications).

Even if your salary review is tied to your performance review, a positive review does not always guarantee a raise. Employers typically reward those who go above and beyond, not just those meeting expectations.

How to prepare for success

Ahead of your performance and salary review, prepare evidence that showcases your impact:

- Accomplishments: Demonstrate how you’ve exceeded KPIs, grown client accounts, or streamlined processes.

- New Skills & Qualifications: Highlight recent CII exams, compliance training, or technical courses.

- Salary Benchmarking Data: Research what professionals in similar roles and locations earn.

- Client & Manager Feedback: Use testimonials or performance metrics that reflect your value.

What if you don't get a raise?

If a salary increase isn’t possible, consider negotiating for other benefits such as:

- CII exam sponsorship and professional development funding.

- Performance-based bonuses or commission structure reviews.

- Flexible working arrangements or additional leave allowances.

If your salary isn’t aligned with the market, it may be worth exploring new opportunities.

The insurance industry is experiencing a talent shortage, and skilled professionals—especially those with strong broking, underwriting, or claims expertise—are in high demand.

If you're considering your options, connecting with a specialist recruitment consultant can provide insight into available roles that match your career aspirations and salary expectations.

Looking for more advice?

Speak to our team today for tailored career insights and market salary trends in the insurance industry.

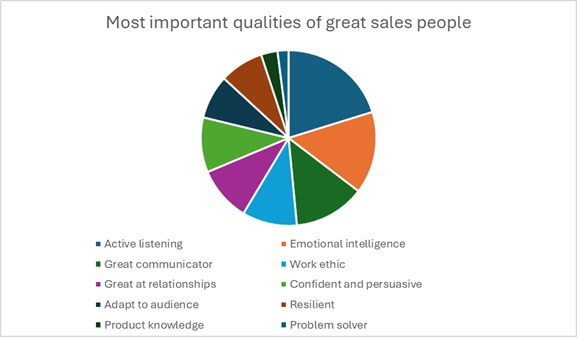

The attributes of the best sales people

In the last few weeks we asked hundreds of UK sales leaders to list the rank 10 attributes of top performing sales people in order of importance.

The additional feedback they offered said that different qualities are required if you are selling something new compared to something that is well established. For example, think about how hard it might have been to sell the first ever robotic lawnmower compared to selling Mars bars to newsagents.

The overall balance of answers provided the list below and its not surprise that being great at listening is the most important quality of a top performing sales person.

|

1. Active Listening – truly hearing and understanding customer needs (20%)

2. Emotional Intelligence – reading emotions, spotting non-verbal signals, adapting (15%)

3. Communication skills – clearly articulating the offering and adapting to the audience (13%)

4. Relationship building – developing trust and long term partnerships (10%)

5. Work ethic and drive – consistently pushing to achieve targets (10%)

6. Confidence and persuasion – demonstrating belief in the products and influencing decisions (10%)

7. Adaptability – adjusting to different customers, industries and markets (8%)

8. Resilience – handling rejection and bouncing back (8%)

9. Product and Industry knowledge – understanding the competitive landscape (3%)

10. Problem solving ability – identifying challenges and providing tailored solutions (2%)

We hope you found this interesting. Maybe you have these qualities and you are looking for a new role or you are a sales leader and need to recruit sales people with the qualities that you need.

Please contact us for more information.

A strong employer brand remains one of the most impactful tools for attracting and retaining talent in 2025. LinkedIn reports that 75% of job seekers research a company's reputation before applying, emphasizing the power of a positive and transparent employer brand.

Why Employer Branding Matters:

- Winning Over Passive Talent: A robust employer reputation can convert passive candidates into active job seekers.

- Boosting Candidate Quality: Strong employer brands attract better-aligned and motivated applicants.

- Retention and Morale: Engaged employees are more likely to stay, reducing costly turnover rates.

Building Your Employer Brand

Immediate Actionable Points:

- Audit Your Online Presence: Regularly update your website, LinkedIn, and other platforms to reflect your values, work culture, and opportunities.

- Promote Employee Advocacy: Encourage team members to share authentic content, such as achievements, culture highlights, and workplace wins.

- Proactively Manage Reviews: Monitor and respond thoughtfully to employee feedback on Glassdoor, Indeed, and social platforms.

Long-Term Strategic Moves:

- Define and Promote Your EVP: Develop a clear Employee Value Proposition (EVP) that communicates the "why" behind working for your organization.

- Publish Thought Leadership: Share valuable insights about insurance careers, growth opportunities, and employee development to showcase industry leadership.

- Track and Measure Brand Impact: Use analytics to gauge employer brand performance, monitor engagement, and refine strategies for continuous improvement.

Final Action Points Summary:

To build a compelling employer brand, focus on refining your online presence, empowering employees to advocate for your workplace, and managing your reputation through thoughtful engagement. Over the long term, define a strong Employee Value Proposition (EVP), publish industry-leading thought leadership, and monitor progress using analytics. By doing so, you’ll attract top talent, improve retention, and position your organization as an employer of choice in the insurance broking sector.

To discuss strategies on how best to achieve the above, please reach out to your Cavendish Maine consultant, who would be delighted to talk through the various ways these can be achieved.

Today's workforce spans five generations, each with distinct values and work styles. In insurance broking, a multigenerational team can drive innovation, but only if managed effectively. According to Deloitte's 2024 Global Millennial and Gen Z Survey, 53% of younger workers cite purpose-driven work and flexibility as top career motivators, while experienced Baby Boomers value stability and knowledge-sharing opportunities.

Key Challenges:

- Diverse Motivational Drivers: Career expectations and engagement priorities vary greatly across generations.

- Communication Barriers: Misalignment in communication styles between generations can create workplace friction.

- Skills and Knowledge Transfer: Ensuring the seamless exchange of expertise between senior staff and younger hires is critical for continuity.

Strategies for Success:

Immediate Actionable Points:

- Offer Customised Benefits: Address generational needs with tailored offerings such as phased retirement, career coaching, or flexible schedules.

- Implement Cross-Generational Mentoring: Foster an environment where knowledge is exchanged through structured mentorship programs.

- Encourage Dialogue: Launch feedback loops (surveys, focus groups) to identify generational challenges and improve cohesion.

Long-Term Strategic Moves:

- Personalised Development Plans: Build generational-specific learning pathways that cater to career ambitions across age groups.

- Promote Diverse Teams: Develop cross-functional, multigenerational teams to solve complex problems and leverage unique strengths.

- Upskill Leaders: Train managers to bridge generational gaps effectively by understanding varied expectations and work styles.

Summary of Advice:

To effectively bridge generational gaps in insurance recruitment, prioritise tailored approaches that address the needs of each age group. Implement customised benefits, mentorship programs, and communication channels to improve cohesion and knowledge transfer. In the long term, focus on personalised development plans, promoting diverse teams, and training leaders to manage multigenerational dynamics successfully. By fostering collaboration and understanding, you can create a more innovative and cohesive workplace.

To discuss strategies on how best to achieve the above, please reach out to your Cavendish Maine consultant, who would be delighted to talk through the various ways these can be achieved.